As New York prepares to launch its first legal adult-use cannabis dispensaries, operators will face the challenge of competing with tax-free Canadian products flowing from the sovereign Native American territory in New York’s North Country.

For nearly three years, cannabis dispensaries have been thriving on the St. Regis Mohawk Reservation, which spans the border between New York and Canada. This unique location allows travelers to move between the two countries without going through customs, enabling the easy exchange of Canadian cannabis and THC-infused products like shaved ice and snack foods resembling popular brands such as Cheetos and Doritos.

While New York State only recently began accepting applications for adult-use dispensaries, the reservation’s dispensaries have had a significant head start, dominating the regional market. Despite this, both the state’s Office of Cannabis Management and the Cannabis Association of New York have largely remained silent, acknowledging the sovereignty of the St. Regis Mohawk Reservation, known as Akwesasne.

Dispensaries on the reservation are open about sourcing products from outside, particularly Canada. Budtenders have candidly shared with reporters that many of their products, including edibles mimicking popular snacks, come from across the border, featuring THC labels from Canada and California.

The prices on the reservation, including pre-rolled joints for as low as $1.58, make it difficult for New York’s upcoming legal dispensaries to compete. Coupled with the lack of taxes, Akwesasne’s cannabis market is expected to continue its dominance in the region, offering products at much lower prices than what New York’s licensed businesses will likely charge under the state’s tax structure.

New York’s regulators and industry representatives remain hands-off, citing the sovereignty of tribal lands. Dan Livingston, Executive Director of the Cannabis Association of New York, emphasized that tribal territories have their own regulations, and the association respects their autonomy. Similarly, the Office of Cannabis Management has shown little inclination to challenge the reservation’s cannabis operations.

An economic impact study conducted in 2018 warned that high taxes could deter consumers from shifting from the illicit market to the legal one. With reservation dispensaries offering cannabis at significantly lower prices, even factoring in a potential 3-ounce transaction limit, many consumers may prefer to travel to Akwesasne rather than purchase from state-licensed dispensaries.

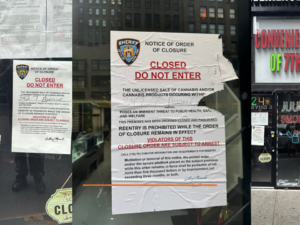

While the St. Regis Mohawk Council has issued licenses for cannabis cultivation and dispensaries, not all businesses on the reservation operate under its jurisdiction. Periodic raids by tribal police have occurred, but the council is working to bring non-compliant businesses into the fold.

Federal authorities have also taken notice. Earlier this year, the DEA intercepted a large-scale cannabis smuggling operation involving a speedboat crossing from Canada into the reservation, highlighting the potential for cross-border trafficking.

As New York’s legal cannabis market takes shape, the impact of the reservation’s well-established cannabis industry will be felt throughout the region. Although the state has the option to enter into agreements with tribal territories, it remains unclear how or if Akwesasne’s cannabis operations will be integrated into New York’s broader legal framework. For now, the reservation’s competitive advantage in pricing and tax-free products poses a significant challenge to New York’s fledgling cannabis market.